In today’s trading session, we executed a strategy that leverages the interplay between SPY and VIX to capture significant market moves. This approach hinges on key our system and timing entries to maximize returns while minimizing risk. Here’s a detailed breakdown of the strategy:

Key Aspects of the Strategy

- Ribbon Switch: The ribbon, composed of various moving averages, helps determine market bias. A switch from bullish to bearish in the ribbon indicates a potential downward trend.

- Entries at EMA Clouds: Utilizing the 13 EMA as a critical level for entries and exits. This moving average acts as both an entry point and a stop loss level.

- Simultaneous VIX/SPY Squeeze: Observing simultaneous squeezes in SPY and VIX enhances the reliability of the trade direction.

Intra-Day Analysis

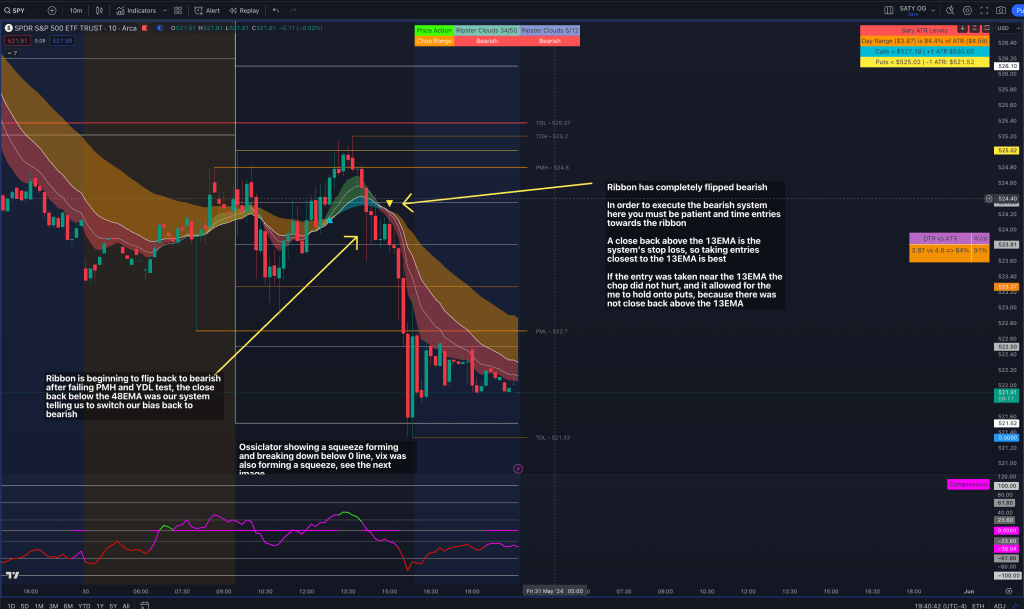

Our analysis is conducted on the 10-minute chart, which provides timely insights for intra-day trades. Today, SPY opened with a gap down and attempted to fill this gap during the day. However, it failed to breach the Pre Market High (PMH) and Yesterday’s Low (YDL), signaling a potential trend reversal. The ribbon confirmed this by switching back to bearish after SPY closed below the 48 EMA of the bullish cloud structure.

Optimal Entry Points

The best entries for this bearish trade were around the 13 EMA. This moving average not only acts as an optimal entry point but also serves as a dynamic stop loss. If a candle closes above the 13 EMA, it signals a potential reversal to a bullish bias, prompting an exit from bearish positions.

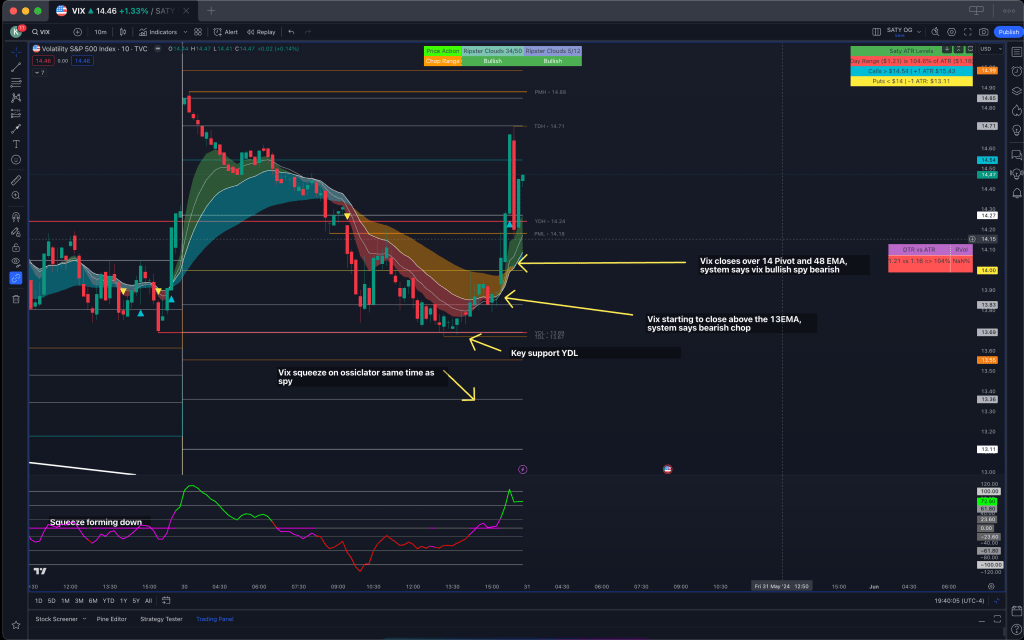

The Role of VIX

The VIX plays a crucial role in confirming market sentiment. Today, both SPY and VIX exhibited simultaneous squeezes on the 10-minute chart, indicating correlated price action. VIX closing above its bearish 13 EMA suggested a bullish transition for VIX, while SPY closing below its bullish 13 EMA confirmed a bearish transition for SPY.

Execution and Positioning

To capture this move, there are two preferred approaches:

- SPY 1DTE Puts: These options provide a balance between risk and reward, allowing traders to capture significant moves without the rapid premium decay associated with 0DTE options.

- SPX 2DTE Puts: Slightly longer expiration than 1DTE, these options offer a good risk-to-reward ratio and can be held through minor pullbacks.

While 0DTE options can offer higher returns (3-4X), they also come with greater risk due to premium crush, especially later in the day. By focusing on 1DTE and 2DTE options, traders can manage risk more effectively and stay stress-free.

Conclusion

This SPY and VIX strategy is a powerful tool for traders, offering the potential for substantial returns when executed correctly. By leveraging key technical indicators and timing entries around the 13 EMA, traders can navigate market volatility with confidence. Remember, the key to success lies in patience, precise entries, and disciplined risk management.

For more detailed insights and trading strategies, visit MDTrader.

Stay tuned for more market updates and trading ideas!

Leave a comment