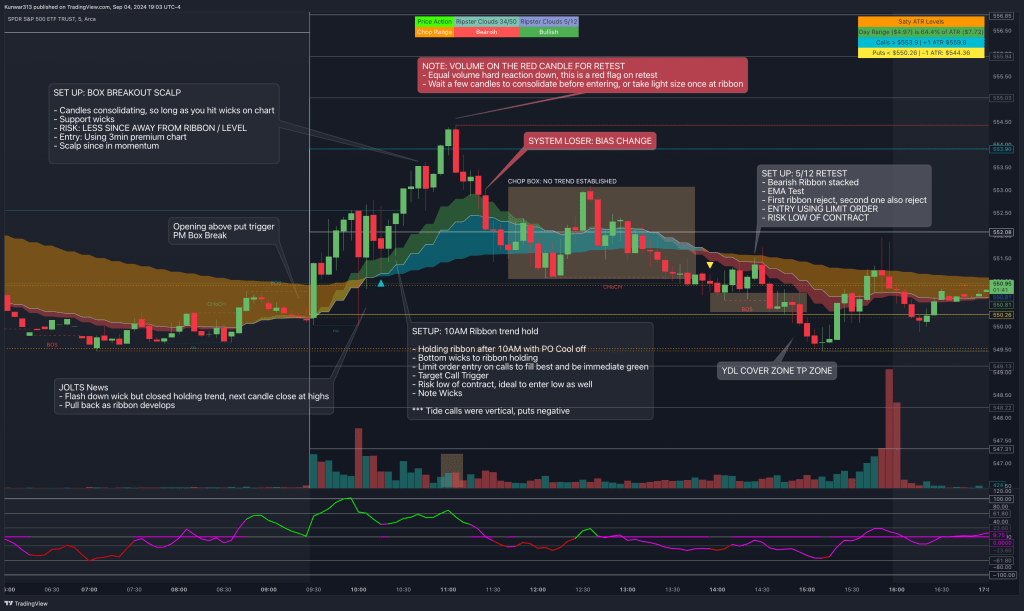

OPEN

-> Spy PM box breakout in amateur move

->Within trigger box 70% we stay within it

-> 10AM Jolts news was a long wick down to PMH and held the trend should not be in plays into 10am news

-> News candle held the 10M trend and next candle closed a bull candle on its highs with good volume

-> Next two candles were retests to the ribbon

SET UP: POST 10AM TREND RIBBON HOLD

-> Consolidation at level with long bottom wicks and key level PMH

-> Two red candles gave wicks to enter in consolidation and hold for a push up towards call trigger

-> ENTRY: Using premium chart

-> Risk: Low of contracts

SET UP: BREAK OUT SUPPORT SCALP

-> Spy break out and had candle wick tests to previous resistance -> 2 Candles of consolidation and 3M Ribbon is in tact

-> ENTRY: using premium chart

-> RISK: 1/3 Sizing since away from chart + Level

We pushed up and out of the call trigger where we had a strong bear candle breaking the previous candles lows on equal volume going into lunch time RED FLAG TO NOT PURCHASE RIGHT AWAY

Support at the ribbon was tested and held with a strong green volume candle, this is okay for entry since it was at support, and the volume bar gave a good indication it was a lot of buying

SYSTEM LOSER contracts lows were immediatley broken, the 13EMA was lost and trend needed to find itself again, all longs should have been cut

Lunch time presented a chop box, where the ribbon was not holding and price was within internal structure Ribbon curled with 8/13/50 now stacked

SET UP: 13EMA BEARISH RETEST

- PO Squeeze

- Ribbon stacked 8/13/50 bearish side

- Limit order entry in to the 13EMA with trend

- RISK: close above the 13EMA

leg down 1

– Consolidated under leg 1 with lots of wicks for RE ENTRY OR SCALING

– YDL Key Level was the best place to cover

SET UPS TODAY

- 10AM TREND RIBBON HOLD

- MOMENTUM SUPPORT SCALP

- 13EMA FAILURE LOSER

- 13EMA BEARISH RETEST