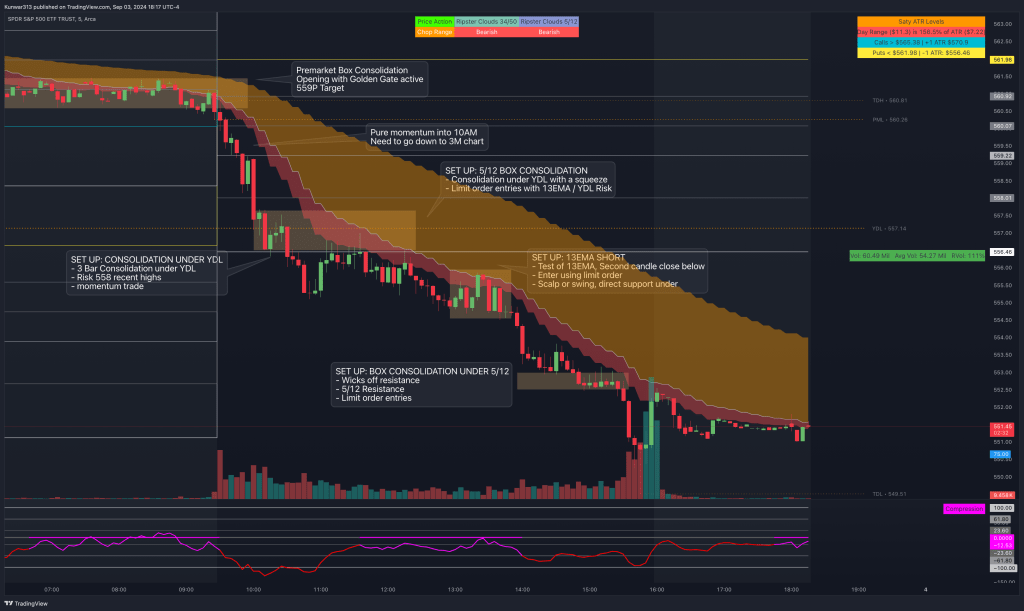

SPY opened with a GAP DOWN under the call trigger and activated golden gate immediatley Amateur move scalps to the downside would have worked, but its the opening bell of monday, it is better to be cautious 10AM held trend going to the downside and completed the golden gate 3M SPX SCALPS IN MOMENTUM WERE OKAY After the second leg down after 10AM we consolidated at 1ATR and YDL

SETUP: BOX CONSOLIDATION UNDER KEY LEVEL

- YDL is a key daily level

- 3 Bar consolidation under YDL with no close above

- Entry: Limit orders targetting highs of contract

- Risk: Close above YDL or momentum push above 558 highs

We made a sharp leg down into some short covering under -1ATR which was supplemented with a bullish divergence on the PO

SETUP: FAILED BULLISH DIVERGENCE + 5/12 BOX CONSOLIDATION

- Bullish Divergence into -ATR

- Resistance from previous leg down and building a squeeze on the PO

- Multiple opportunites to short under -ATR with limit order entries, and no major moves above YDL that would have taken out the stop loss

- Entry: Limit Orders at recent wick highs

- Risk: Close above 13EMA or YDL

SET UP: 13EMA RETEST

- Leg down after box consolidation into a small accumulation event

- Price pushed into 13EMA which gave an opportunity to short, but you don’t short the first touch immediatley

- Price closed at its highs, and then on the second candle there was a close back below the 13EMA

- This gave an opportunity to set limit orders on the short to target another leg down

SET UP: EOD BOX CONSOLIDATION

- Leg down from previous move provided a clear box consolidation with wicks off resistance

- Entries using limit orders gave good opportunity to enter short

- SPX 0DTE or SPY 2DTE for R/R