Today we nailed the push to all time highs using the daily plan the premarket planning from the night before using multi time frame analysis. Let’s look forward to tomorrow!

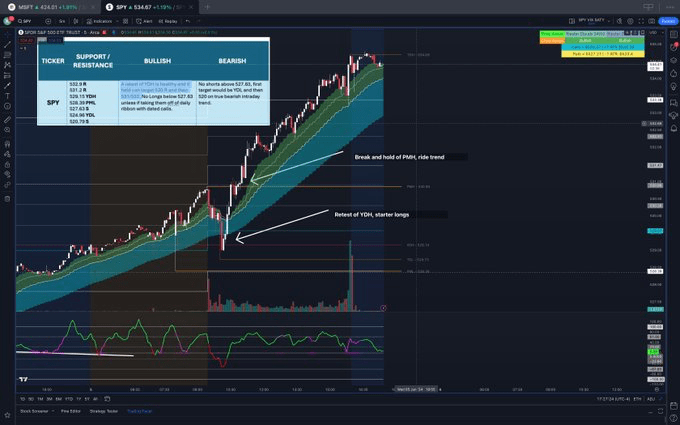

Daily Time Frame

- The daily chart showed a flag break, with retests of the ribbon leading to a push to all-time highs.

- A squeeze is building on the daily, indicating a continuation of the uptrend on both the weekly and daily time frames.

- This week’s upside target for SPY is ~540 and SPX ~5400.

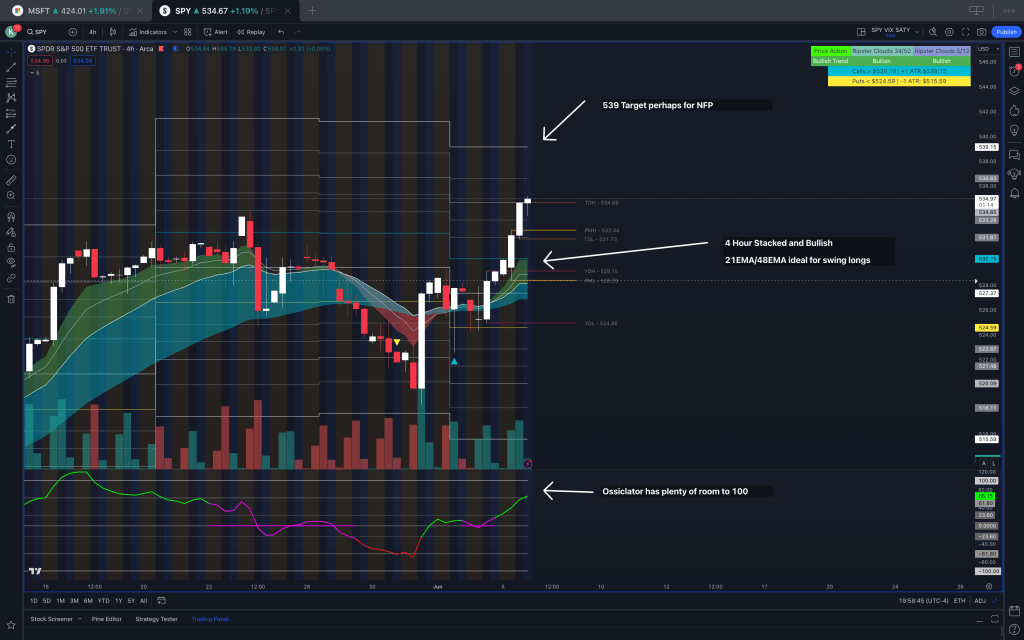

4H Time Frame

- 4H Ribbon has officially established bullish structure with all EMA’s stacked appropriately

- The 4 hour EMA’s are now valid zones to purchase long calls , I prefer dated SPX and SPY

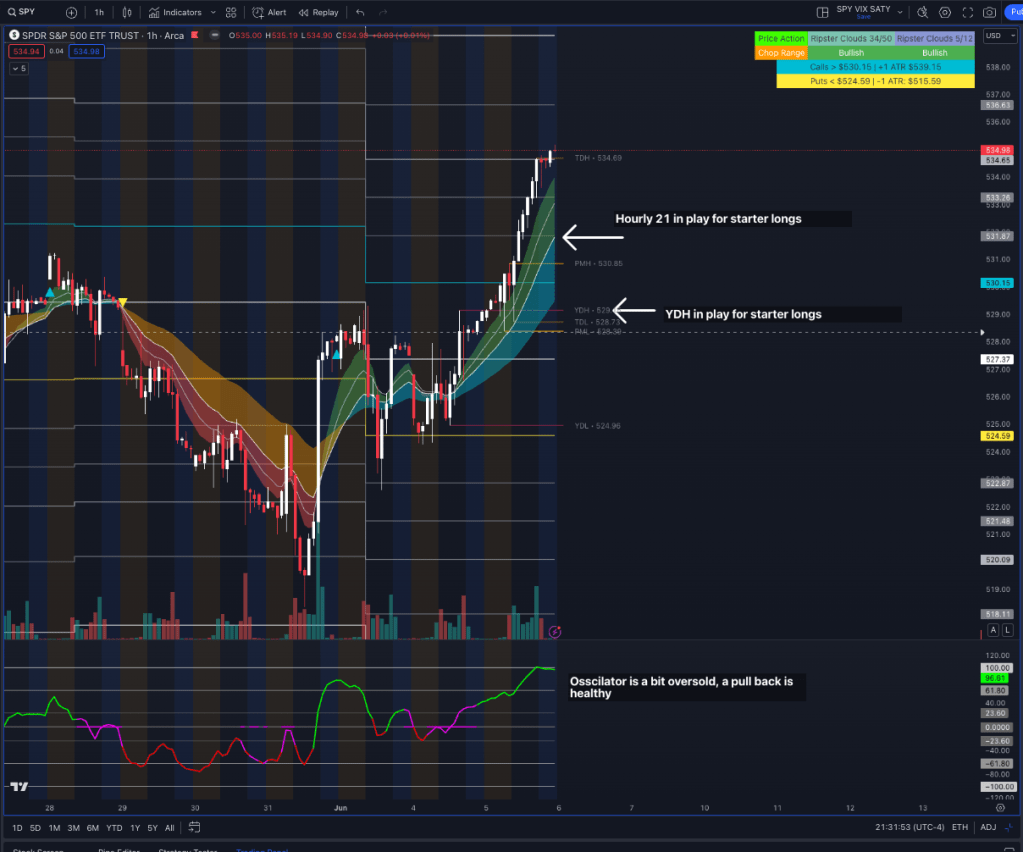

1H Time Frame

- Hourly structure is great to play with tight risk, I would take starter longs and be proactive in managing the position

- Using multiday ATRs can prove to be good targets for the upside move

- Once again allow price action to guide you

- Friday is NFP a very volatile market event, with only 2 days left we may see an accumulation period on the Thursday and a move on the friday, however, we will play the chart

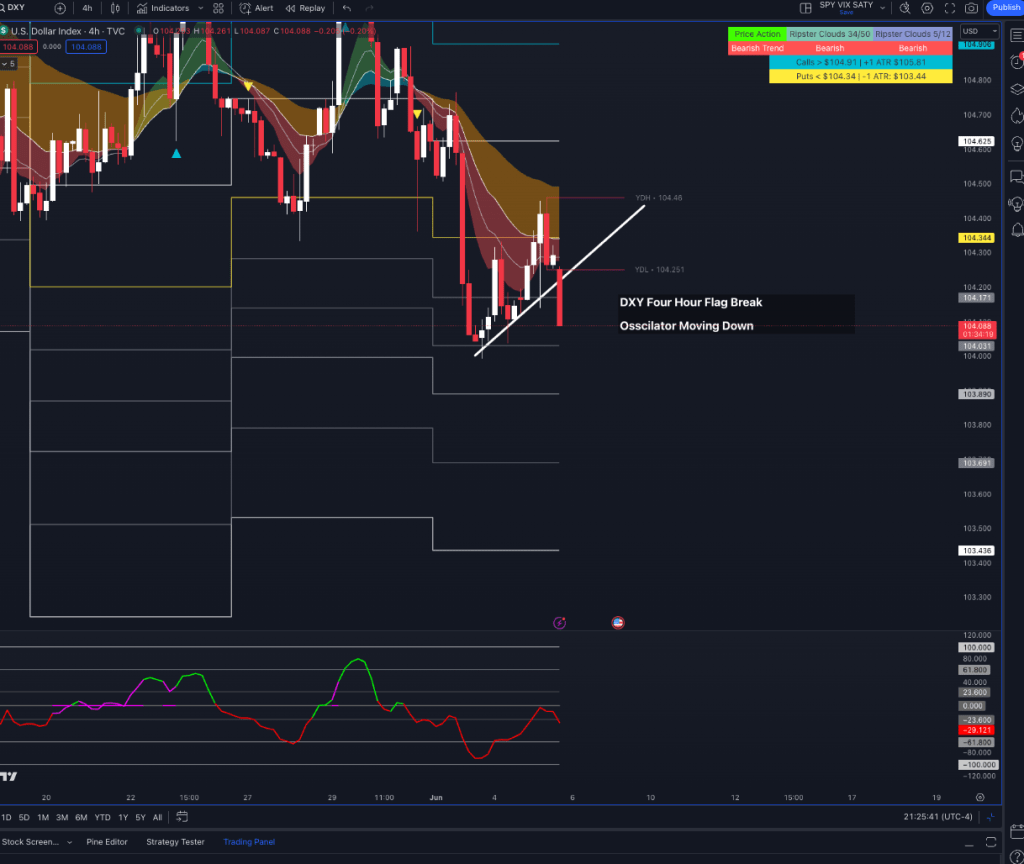

DXY

- DXY is continuing it’s downtrend with a 4 hour flag break

- The oscillator is in a strong downtrend and will likely aid the move down

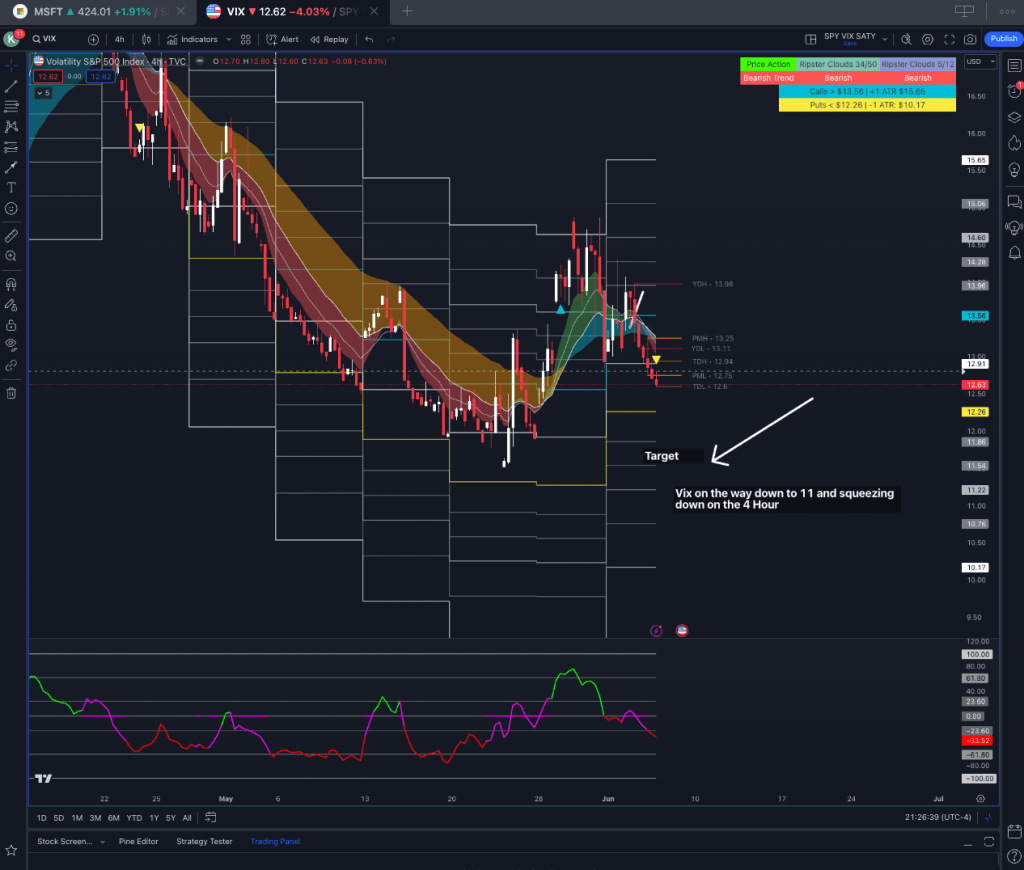

VIX

- VIX has returned back its downtrend after a short accumulation period

- VIX can be favoured for a move down to 11

Execution Tips

- I will be using the hourly and 4 hour to guide my entries and be using dated SPX and SPY

- Thursday may be an accumulation event, in anticipation for NFP on Friday

- If there is any dips I will be purchasing them using the hourly and the 4 hour charts