Key Lessons (commentary below)

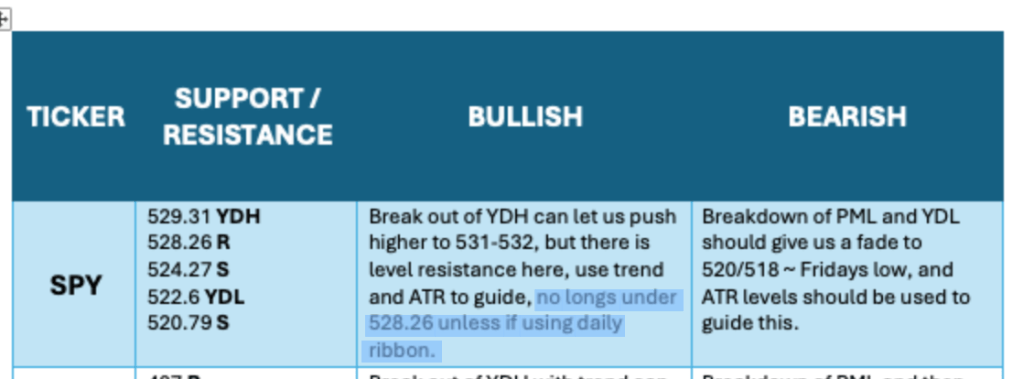

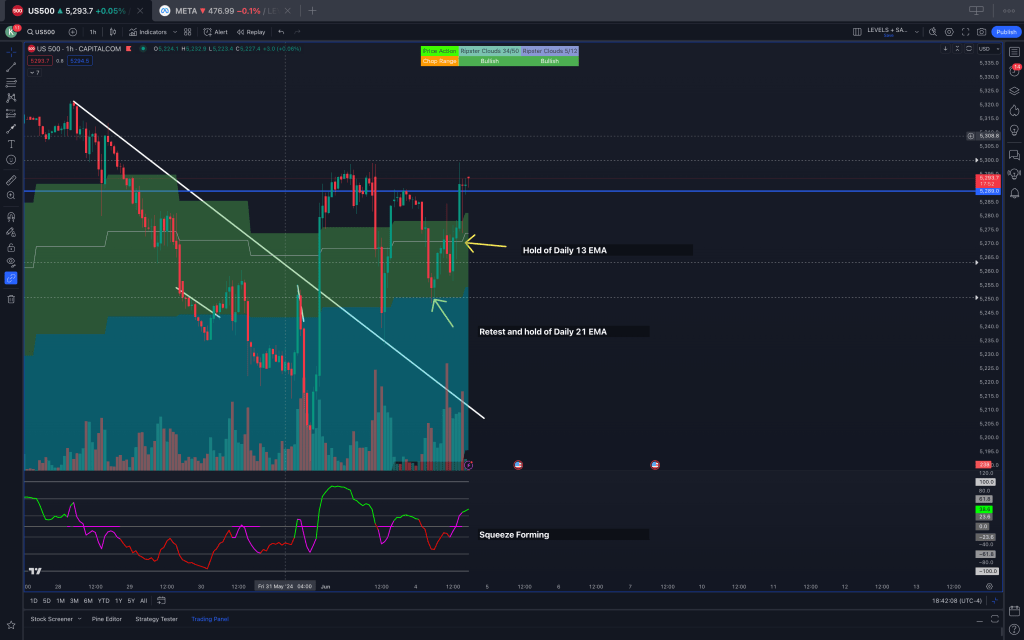

Daily Chart for SPX

- Consistent Support Zones: The daily 21EMA has proven to be a reliable support zone for the SPX, making it an optimal entry point for long positions. This strategy capitalizes on the sustained trend, allowing for substantial gains when the price rebounds off this level.

- Extended Time Horizons: Utilizing SPX options with 6-7 days to expiration (6DTE) provides enough time for the trade to develop, mitigating the impact of daily fluctuations and option greeks. This approach maximizes the potential for larger percentage gains, as evidenced by the contracts reaching a 200% gain.

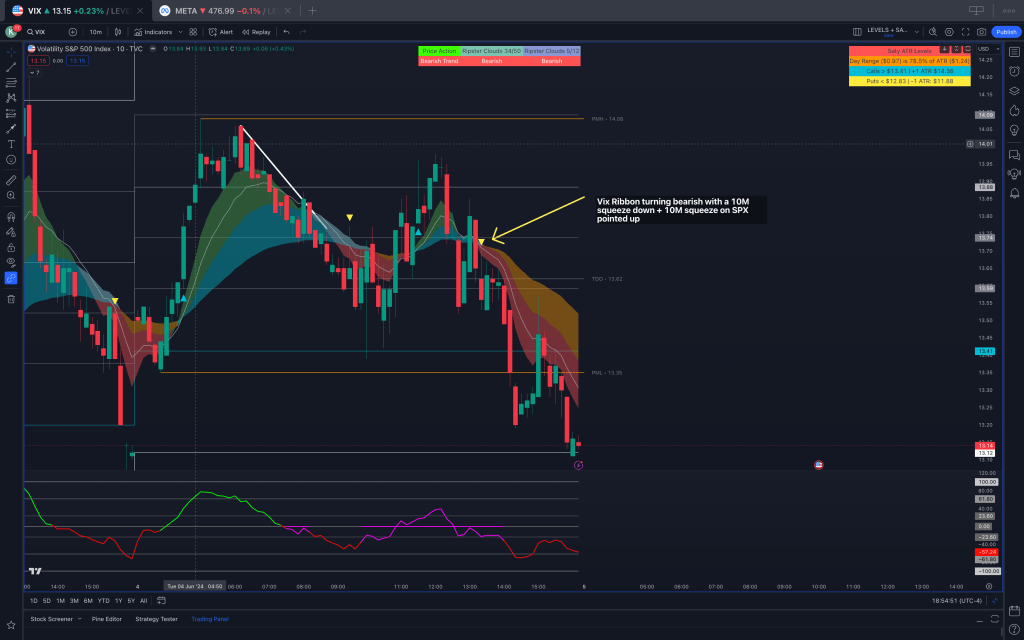

VIX/SPY Strategy

- Pre-market Analysis: Observing overnight market movements can help predict early session behavior. Large overnight ranges often lead to choppy morning sessions, providing a setup for strategic entries.

- Contrary Squeeze Signals: Identifying squeezes on both the VIX and SPY that point in opposite directions can signal a strong trade opportunity. In this scenario, the VIX’s bearish squeeze coincided with SPY’s bullish trend, creating a favorable setup for long positions.

- Strategic Execution: Using SPX options with 2 days to expiration (2DTE) can yield significant returns during these setups, as demonstrated by the options achieving over 100% gains.

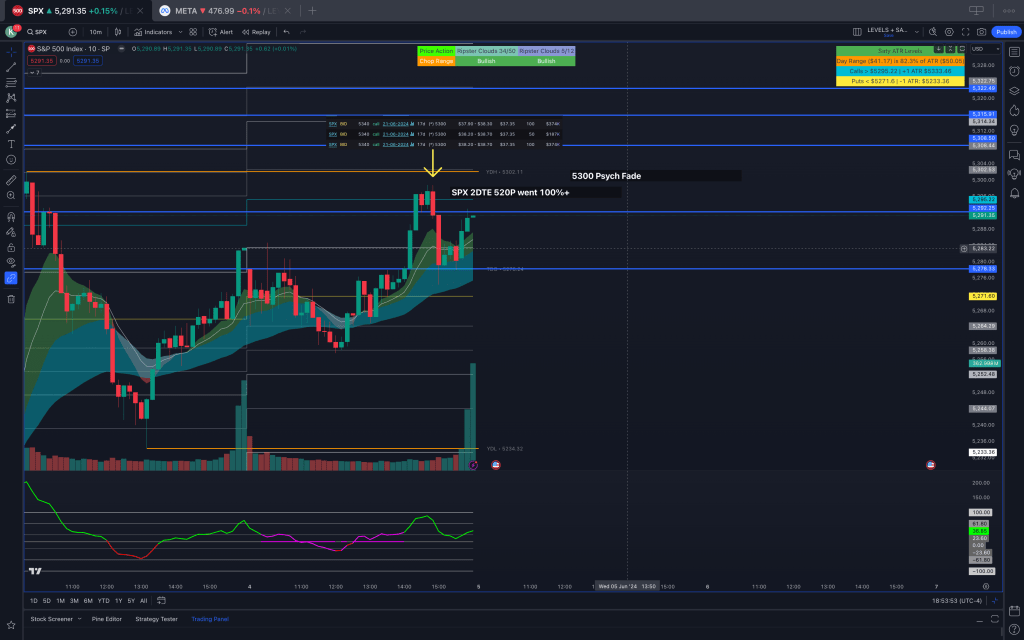

SPX 5300 Psychological Fade

- Psychological Levels: Recognizing psychological resistance levels, like SPX 5300, can provide strategic opportunities for fades. Waiting for these levels to reject multiple times confirms the strength of the resistance.

- Volume and Premium Analysis: Monitoring option premiums and trade volumes can offer insights into market sentiment and potential reversals. Observing significant premium sales indicated strong resistance, validating the fade strategy.

- Short-Term Puts: Purchasing short-term puts (2DTE) in anticipation of a pullback can be highly profitable. In this case, the SPX 5210P contracts increased from ~1.3 to 3.5, showcasing the effectiveness of this approach when timed correctly.

Using Daily Chart for SPX 6DTE

For the purpose of this part of the execution I would like to focus on the daily ribbon. The chart shown illustrates the hourly candles on the US500 daily chart which represents the overnight session as well. Overnight we tapped the daily 21EMA, here is where I purchased 6DTE 5375C on SPX for ~1.7-2.1. The daily 21 has been a consistent zone of support and can be purchased long with the daily ribbon, buying extra time for a move that would take time to unwind, which is what we saw today. The daily 21 coupled with SPX 6-7DTE provides for a unique opportunity to take advantage of all day trend’s without being hampered by the option greeks. Contracts at their peak went to $5 leading to an over 200% gain.

VIX/SPY Strategy

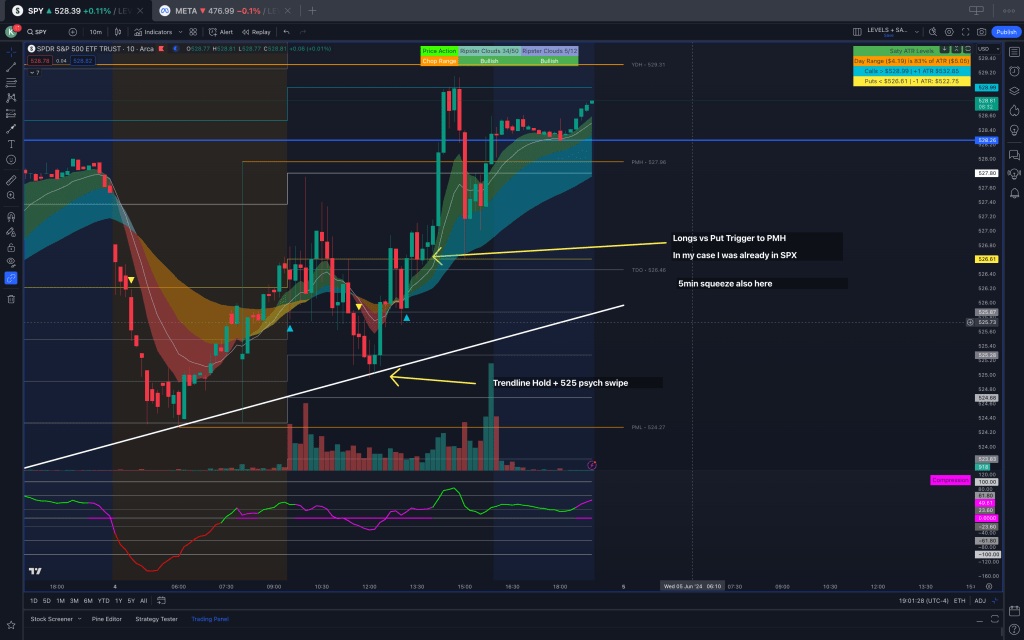

The morning began with choppy action which was expected given that the overnight session had such a large move, often times when the overnight move has lots of range we can expect the beginning of the New York session to see some form accumulation/chop period. VIX attempted to turn bullish and push towards 14 where it began to fail. The ribbon ultimately flipped bearish with a 10M squeeze on the oscillator pointing down.

During the same time of the VIX squeeze forming we saw SPY reclaim its 10M trend after bouncing off of a premarket trendline. When we see VIX and SPY having squeeze’s at the same time, in opposite directions, especially given the price action on the hourly time frame, we can confidently take longs vs the put trigger level or the 13EMA of the 10M ribbon. I like to execute these with SPX 2DTE which went 100%+.

SPX 5300 PSYCH FADE

The psychological number fade on SPX is a classic play that can yield great returns. After taking calls on SPX in the initial squeeze, I expected resistance against the 5300 level, but I was not too hasty to enter these. I waited for the level to reject a few times, and saw calls being sold with over 500K in premium at this time as well. In order to execute this I purchased 2DTE puts with small size with contracts costing around ~1.3 SPX 5210P, these contracts went upwards of 3.5 before meeting support.