Coin has been an intriguing ticker for traders and investors alike. Recently, it’s been in a phase of consolidation, but it displayed a potentially favourable bullish candle to the upside last week. This shift has certainly changed the outlook for Coin.

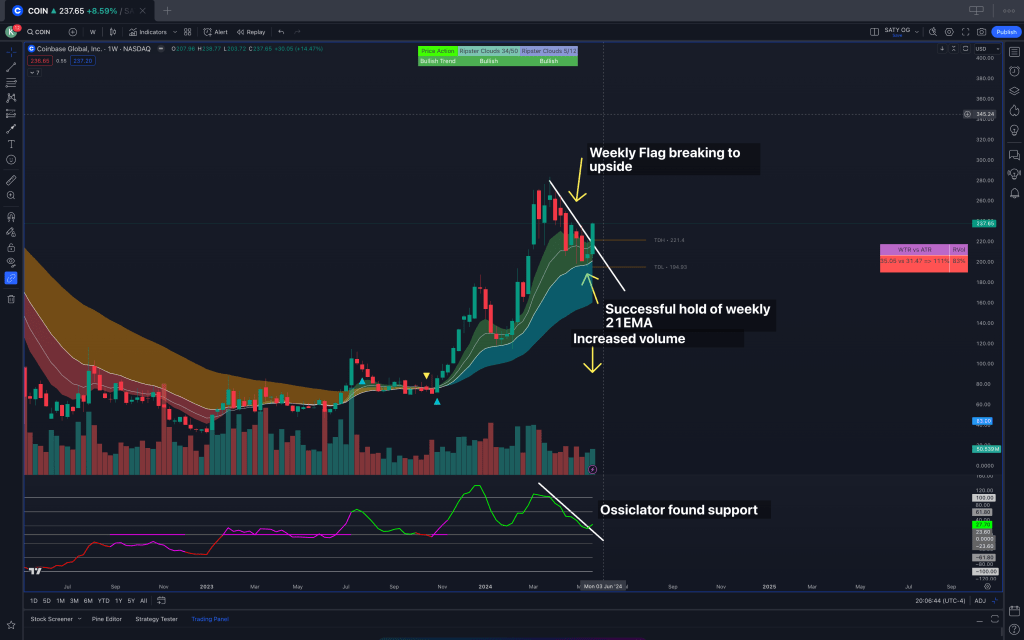

Weekly Time Frame

Looking at the weekly time frame we see a clear bull flag that has broken the upside trendline, now the key is to hold this trendline. Its a good sign for longs that we held EMA’s and maintained bullish cloud structure, on increasing volume. The ossiclator on the weekly also looks healthy at support and ready to curl up.

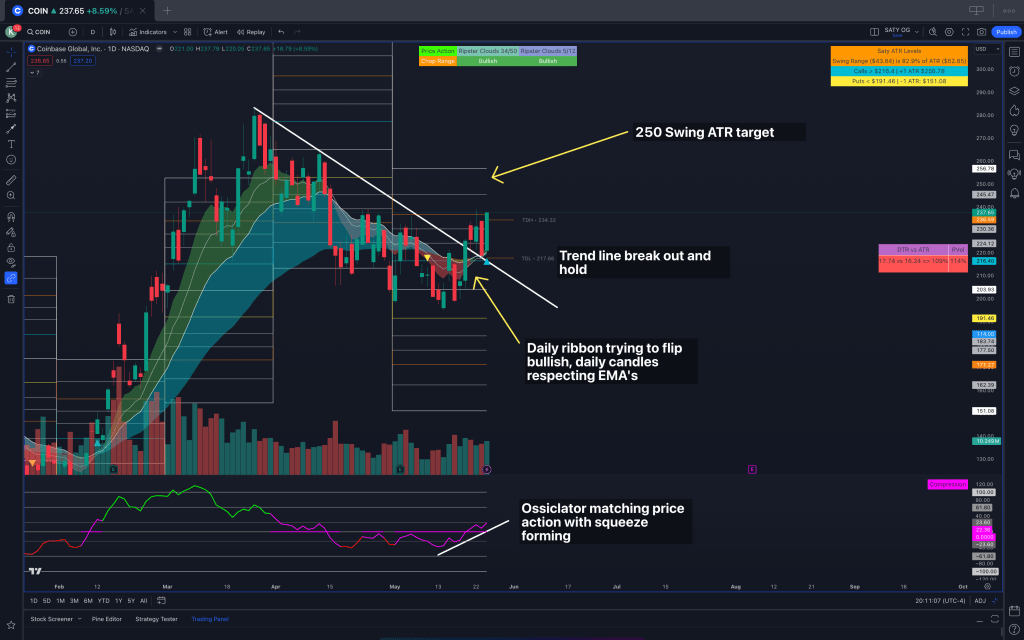

Daily Time Frame

The Daily time frame is where things get really interesting. Here we have clearly broken the trendline to the upside, and retested it with a strong hold. The ribbon has not completely turned bullish, but a closer look and we are respecting EMA supports. It is also a great sign to see the osscilator has been forming a squeeze this whole bull flag down, and is now curling up with recent bullish price action. The swing ATR target is 250, and using daily levels will be key here. Best entries for a swing will take place at the low of the previous daily candle, but we must be prepared to match the price action for the day.

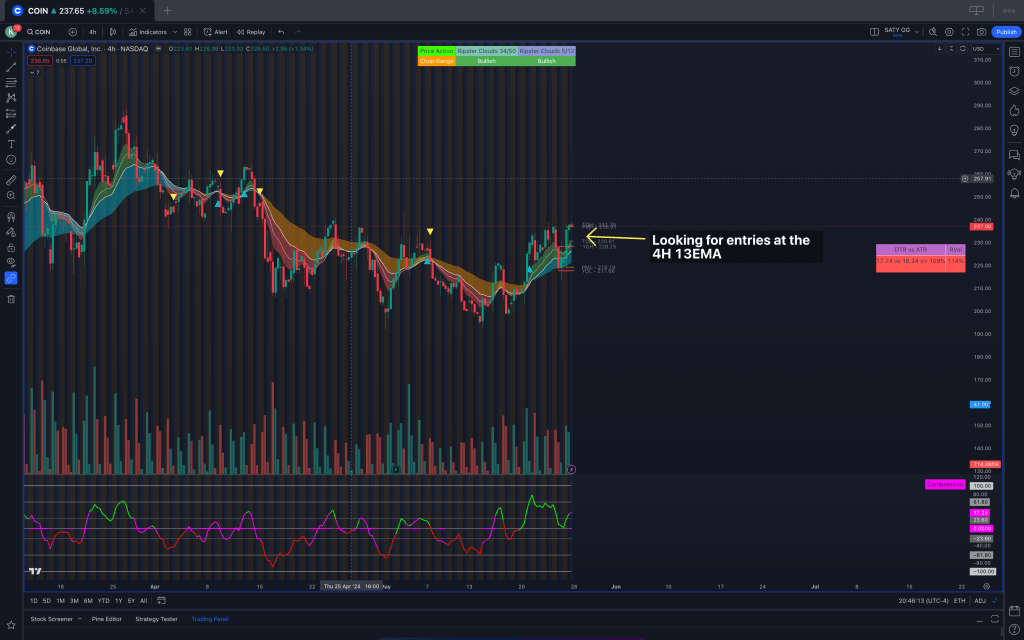

4H Time Frame

The 4Hour time frame is where we will aim to time our entries, there are two entry points here, and early entry with bullish price action on the day will be the 13 EMA, but with more drawdown on the name we can test the 21/48EMA and these are valid entries as well. If taking position at 13EMA its important to recognize you should size down, as the retest down to the 48EMA is completely valid.

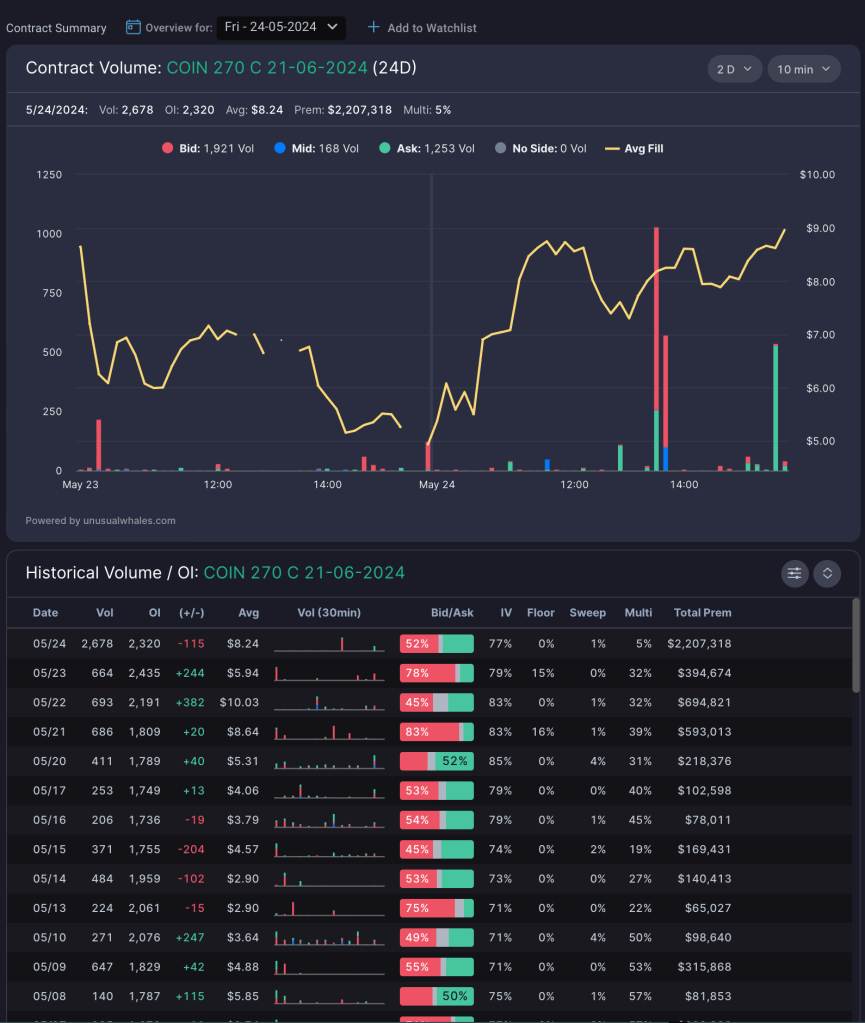

Flow + Execution

A Noteworthy Flow of Traders

The flow of traders demonstrates interest in the 270C June 21st, with rising Open Interest (OI) over the weeks, and remarkable volume in Friday’s session with more than 2M in premium traded.

Personally, I’ll be aiming for the 350C June 21st for a day trade, and then extend these further if the price action aligns with the thesis. Consequently, the Coin remains an appealing and potentially profitable focus for traders.

Leave a comment