This week in the market, we have seen some interesting dynamics unfold. As traders, it’s crucial to keep an eye on these changes and adjust our strategies accordingly. One such intriguing development is the short idea for Square Inc. ($SQ). Here’s what we’ve noticed.

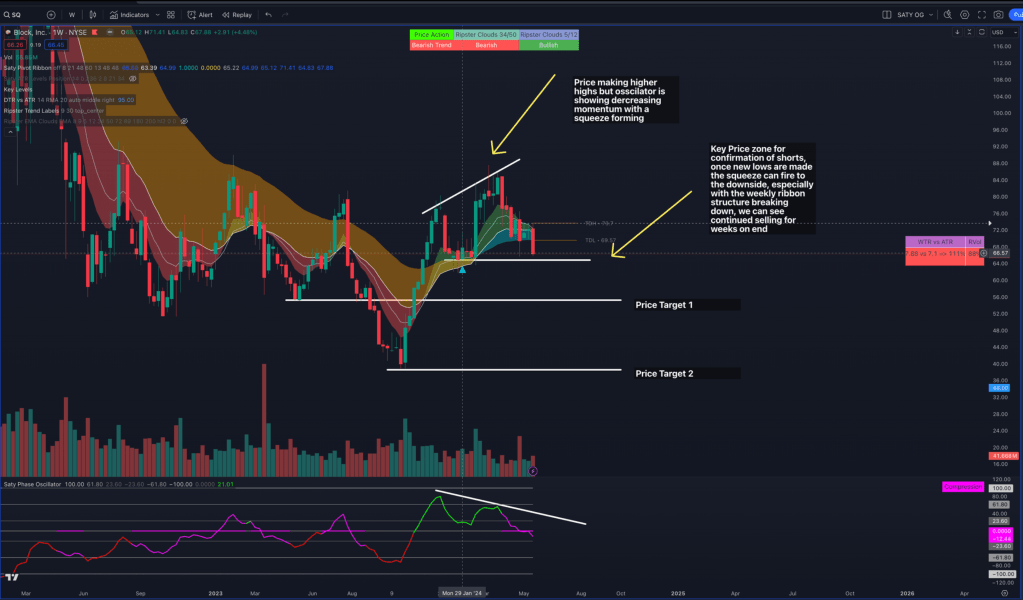

Weekly Time Frame

In the weekly time frame, we are observing price divergences with the oscillator. The weekly time frame has been making new highs and then selling off. We see key support down below, but this can be taken out due to the forming squeeze which is breaking down supports on the weekly time frame. Confirmation below the first support level illustrated should trigger the weekly squeeze to the downside, with profit targets designated. Interestingly, the weekly ribbon breaking down the 48EMA is confirmation that the bullish trend is beginning to break down, and we may revert back to the greater time frame downtrend.

Daily Time Frame

On the daily frame, we’re starting to see a rejection of its bullish structure with the price making new lows. A key aspect to focus on here is the flip of the ribbon, alongside the daily squeeze beginning to form to the downside. This daily downside squeeze, nested into the weekly downside squeeze, gives us confidence that when the squeeze fires, it should fire on both time frames leading to a more significant move. We would like to see the first support on the daily frame broken to have conviction in this short side play.

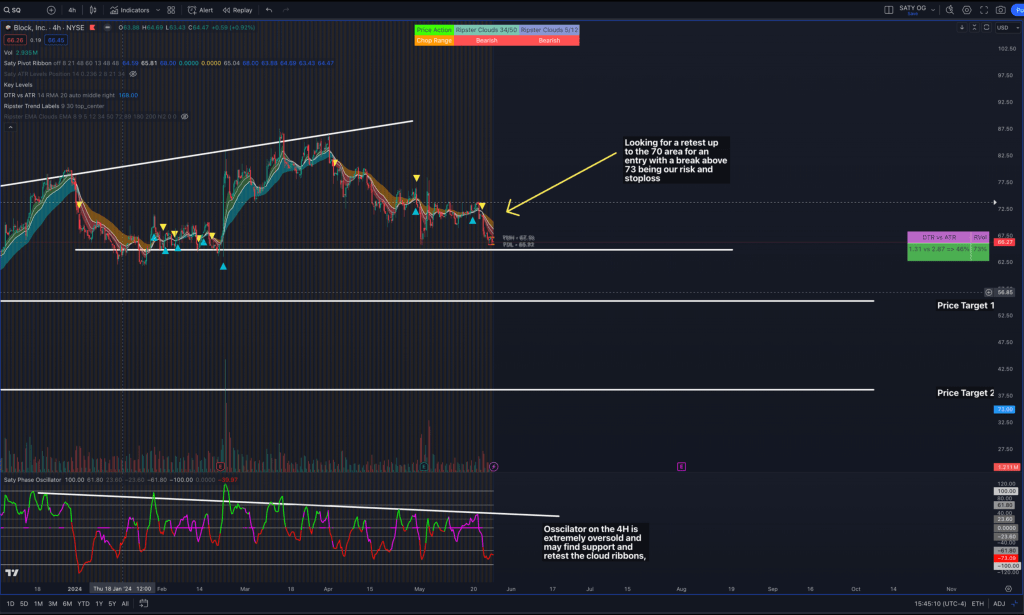

4HR Time Frame

The 4-hour time frame is where we prefer to take our entries. Currently, this time frame is oversold with a ribbon retest in play. Ideally, we want the price to retrace back towards 70 for an entry into dated $SQ Puts. We’re also looking for the price to respect the EMAs and for our stop loss to be above 73.

SQ Strike Selection

Looking forward, I am interested in the $SQ $60P June 26, which are trading at around $1. A pullback should take premiums to $0.70, which would be an optimal entry. A breakdown to the first price target should inflate these contracts to approximately $3-4, providing good returns. My recommendation for execution is to wait until we pull to the EMA’s on the 4 Hour time frame and then size down so that these contracts can be held longer and reach the price targets. Once we reach targets, it could be a good idea to take profit and roll the strikes further, if the play continues in our favour.

Stay tuned for more market updates and trading ideas. Remember, the key to successful trading is patience and consistency.